Section 40 Liens, Workers’ Compensation and Third Party Prospective – What Does Dever V. NJM Really Stand For?

Christopher DiGirolamo will speak on this topic at the New Jersey Association for Justice Educational Foundation’s Meadowlands Seminar

Case law is constantly evolving, and these shifts can have major implications for attorneys throughout the state—and even the country. The decision in Dever v. New Jersey Manufacturers Insurance Company, however controversial, carries significant weight for lawyers involved in workers’ compensation claims and Section 40 liens. Understanding the outcome of this case is crucial to successfully navigating a New Jersey workers’ compensation claim.

Case law is constantly evolving, and these shifts can have major implications for attorneys throughout the state—and even the country. The decision in Dever v. New Jersey Manufacturers Insurance Company, however controversial, carries significant weight for lawyers involved in workers’ compensation claims and Section 40 liens. Understanding the outcome of this case is crucial to successfully navigating a New Jersey workers’ compensation claim.

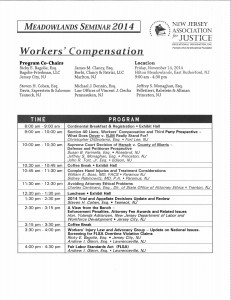

Managing Partner Christopher DiGirolamo will speak at the New Jersey Association for Justice Educational Foundation’s Meadowlands Seminar on Friday, November 14. The event, held at the Hilton Meadowlands Hotel in East Rutherford, New Jersey, covers a wide range of legal topics over three days. DiGirolamo will give a presentation entitled “Section 40 Liens, Workers’ Compensation and Third Party Perspective — What Does Dever v. NJM Really Stand For?” from 9-10 a.m. Friday morning. Visit the New Jersey Association for Justice website for more information about attending this discussion or other events during the Meadowlands Conference.

Section 40 Liens and Workers’ Compensation

Understanding Dever v. NJM first requires a thorough understanding of several key concepts in New Jersey workers’ compensation law:

Workers’ compensation is a no-fault insurance program that compensates employees for medical treatment, lost wages, and disability if they suffer a work-related injury or illness. Being a “no-fault” program, workers’ compensation payments are made regardless of who was at fault in the incident. This type of program benefits injured workers by ensuring they receive prompt payment after an accident, rather than going weeks or months without steady income while everyone attempts to determine fault. However, the trade-off for this no-fault program is that, in the vast majority of cases, the worker gives up his or her right to file a personal injury lawsuit against the employer. However, there are certain cases when an injured worker still has a right to file a personal injury suit, which are discussed further below.

Third-party lawsuits are the crux of Dever v. NJM and similar lawsuits. While an injured worker may give up the right to sue the employer by accepting workers’ compensation payments, he or she may still have a lawsuit against a third party. Depending on the circumstances, a liable third party could be a manufacturer of unsafe equipment, the driver of the car that struck you, the distributor of unsafe chemicals, the contractor at a construction site who failed to ensure a safe work environment, or the third-party vendor working at your place of employment who created a safety hazard.

Double recovery is when a plaintiff receives compensation from one source, then receives additional compensation from another source; in terms of workers’ compensation, the plaintiff receives workers’ compensation payments, then also recovers money in a third-party lawsuit. Double recovery is prohibited by New Jersey law, as injured workers are not allowed to “profit” from their injury by recovering twice.

Section 40 liens are put in place to prevent double recovery. To put it simply, an employer and its insurer have the right to reimbursement for medical and temporary benefits paid to an employee if a third party was liable for the injury. Therefore, if an injured worker is seeking compensation from a third party, the employer/its insurer can apply a lien to the claim, asserting their stake of the damages awarded. For example, say a workers’ compensation carrier pays out $50,000 in medical benefits and temporary disability benefits to an injured worker. The worker then brings a suit against the third party responsible for the accident and recovers $250,000. The Section 40 lien would then come into play, and the workers’ compensation carrier would be entitled to (partial) reimbursement of the $50,000 it originally paid out. This way, the injured worker benefits from the third-party suit, while not “profiting” from the accident by receiving payments from two different sources.

Background on Dever v. New Jersey Manufacturers Insurance Company

Mr. Dever sustained severe injuries in a car accident while on the job, and the other driver had a policy limit of $25,000. Dever received medical benefits from his workers’ compensation carrier, settled his third-party claim with the other driver for the full policy limits, and then filed a claim under his Underinsured Motorist Policy.

Mr. Dever sustained severe injuries in a car accident while on the job, and the other driver had a policy limit of $25,000. Dever received medical benefits from his workers’ compensation carrier, settled his third-party claim with the other driver for the full policy limits, and then filed a claim under his Underinsured Motorist Policy.

During trial, the jury awarded Dever only $275,000 in damages after finding he did not prove a permanent injury. During appeal, the insurance carrier argued that it should be reimbursed for the medical expenses Dever recovered in court because of the double recovery concept. In past cases, New Jersey courts have treated underinsured motorist (UIM) payments just like recovery from a third party. Therefore, the Section 40 lien applies and the workers’ compensation carrier is entitled to reimbursement for the benefits it paid to the worker.

However, the court decided differently in Dever. The court made two key decisions in this case:

- When an employee is injured in a work-related car accident, workers’ compensation is the primary avenue for recovering medical expenses

- A workers’ compensation carrier has no right to Section 40 payment of medical benefits from the UIM carrier

Essentially, the court decided that a Section 40 lien against damages in a third-party case cannot include medical expenses awarded through New Jersey’s workers’ compensation program. The court held that allowing the employer to recover a Section 40 reimbursement from a UIM carrier contradicts the legislative intent of the workers’ compensation scheme, and therefore should not be allowed.

Implications of the Ruling

This ruling is particularly confusing when you consider established court law on double recovery and workers’ compensation. At the end of the day, the ruling limits the subrogation rights of the workers’ compensation carrier–at least for now.

It is important to note that Dever is an unpublished case, so it is not legally binding. The case is considered “persuasive,” meaning each judge or court can make an individual decision about the reasoning of the case and whether or not it is persuasive in another context. It remains to be seen how this decision will impact workers’ compensation litigation in New Jersey and for how long Dever will continue to apply.